About Us

It is possible now !!. Yes, today there are more than 9 million Indonesia migrant workers living and working outside the country at all over the world, and in average more than 200,000 Indonesian Migrant Workers are going abroad every year, and all of them demand affordable, secure, fast, transparent and easy way to make their payment and or sending their money to their home family. It is estimated that the total remittance from all the Indonesia workers overseas is reaching approximately of 11 Billion USD per annum.

We believe that the impossible is only part of the journey. That is precisely, why we created a digital platform of payment cross border for Indonesia migrant workers at overseas. Our greatest commitment at last, is to make financial services accessible for our end users to support of all their financial needs at their fingertips and real time.

We understand that the International financial transactions require a change of currency, foreign transaction fees, handling the exchange rate, and coordinating with different domestic entities depending on the country. And we offer highly competitive exchange rates to our users through fast and easy-to-use services, from instant personal payments and fund transfer.

When we think about purpose, we believe our impact it’s more than just payments. It is about providing every of Indonesia migrant workers overseas to share their income to their family at home country and allow them to spend for education, culture, entertainment, commerce and making the most diverse kind of services and products.

Our Vision

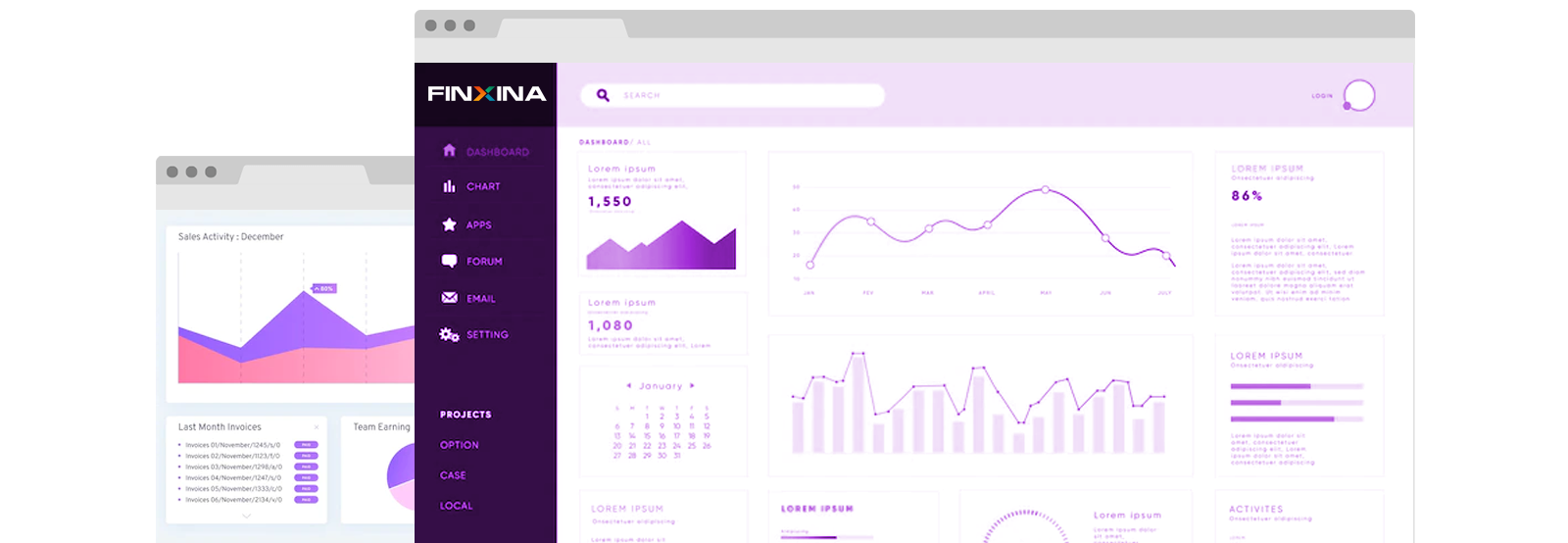

Digitalization of Financial Transaction, by building SaaS Platform that can deliver functionality for Cross Border Payment and Fund Transfer.

Our Mission

Delivering digital platform of payment cross border for automation of remittance using platform that allow any devices which capable of supporting Web Version-Android-IOS operating system, to perform payment and fund transfer by Indonesia migrant workers at overseas to their home family, with acceptable and favorable conversion exchange rate, affordable transaction fee, easy for scaling up, and full compliance with regulation and sanction at back office.